Roscan Gold Intersects 30m at 2.96gpt, 20m at 2.38gpt and 17m at 2.66gpt at Kabaya and Significantly Extends Gold Mineralization to 196m Depth

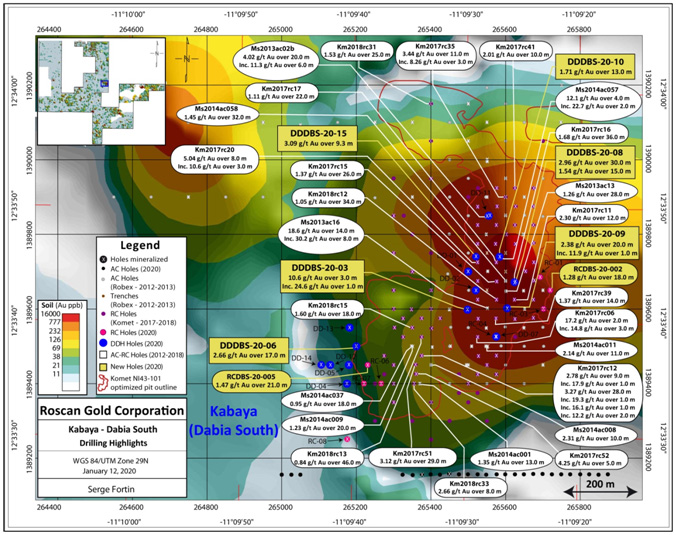

Toronto, Ontario. – January 19, 2021 – Roscan Gold Corporation (“Roscan” or the “Company”) (TSX-V: ROS; FSE:2OJ; OTC:RCGCF) is pleased to announce positive Diamond and RC drill results (Figure 1) from 23 holes totaling 4,158 metres (m) at its Kabaya Target with multiple holes intersecting high gold grades over wide intervals. Drill hole DDDBS20-008 (Figure 1) intersected 2.96 gpt over 30m starting from surface. Drill hole DDDBS20-009 intersected 2.38 gpt gold over 20m from 46m, Drill hole DDDBS20-006 intersected 2.66gpt over 17m from 166.2m and hole DDDBS20-14 ended in gold mineralization at 247.2m depth (Figure 2).

Kabaya – DD + RC Drilling Highlights

- 10.6 gpt gold over 3m from drill hole DDDBS20-003 from 84.6m

-

- Including 24.6 gpt gold over 1m from 84.6m

- And 1.64 gpt gold over 9m from drill hole DDDBS20-003 from 57.8m

-

- 3.09 gpt gold over 9.3m from drill hole DDDBS20-015 from 0m

-

- Including 8.73 gpt gold over 2m from 4.3m

-

- 2.96 gpt gold over 30m from drill hole DDDBS20-008 from 0m

-

- Including 11.7 gpt gold over 2m from 26m

- And 1.54 gpt gold over 15m from drill hole DDDBS20-008 from 34m

-

- 2.66 gpt gold over 17m from drill hole DDDBS20-006 from 166.2m

-

- Including 7.45 gpt gold over 2m from 171.2m

- And 1.07 gpt gold over 15m from drill hole DDDBS20-006 from 143.2m

-

- 2.38 gpt gold over 20m from drill hole DDDBS20-009 from 46m

- Including 11.9 gpt gold over 1m from 64m

- 1.93 gpt gold over 7m from drill hole DDDBS20-014 from 233.2m

- 1.71 gpt gold over 13m from drill hole DDDBS20-010 from 0m

- 1.65 gpt gold over 9m from drill hole RCDBS20-06 from 74m

- 1.47 gpt gold over 21m from drill hole RCDBS20-005 from 109m

- And 0.79 gpt gold over 16m from drill hole RCDBS20-005 from 90m

- 1.28 gpt gold over 18m from drill hole RCDBS20-002 from 141m

Notes: 1: True width yet to be determined, 2: Table 1 – Assay Highlights, 3: 0.5gpt used as cut-off with 2m internal dilution for drill holes, 4: No top-cut.

Since acquiring Kabaya in June 2020, all 23 holes drilled intersected gold mineralization (Table 2) which reflects a 100% drill success rate. The Kayaba deposit (see Disclosures below1) has a pit-constrained mineral resource to a depth of 58m, which contains 105,000 ounces of Indicated Resource and 35,000 ounces of Inferred Resource. We have now established mineralization to a depth of 196m which remains open. (Figure 2)

1Kabaya Project (Source Komet’s NI 43-101)

The mineral resource is based on optimized pit shells using a gold price of US$1,350 and a presumed heap leach gold recovery of saprolite material.

| Classification | Tonnage (Mt) | Au (g/t) | Ounces (koz) |

|---|---|---|---|

| Indicated | 3.17 | 1.03 | 105 |

| Inferred | 0.96 | 1.14 | 35 |

Pit Constraint Mineral Resource

- Effective date for resources is January 7, 2019. (Source Komet’s NI43-101)

- The independent QP for this resources estimate is Yann Camus, Eng., SGS Canada Inc.

- The mineral resources are presented at a 0.4 g/t Au cut-off grade in pits.

- The resources are presented without dilution.

- Whittle pits have been utilized based on a gold value of US$1,350/oz.

- Mineral resources that are not mineral reserves do not have demonstrated economic viability.

- No economic evaluation of the resources has been produced.

- This Resource Estimate has been prepared in accordance with CIM definition (2014).

- Density used is of 1.7 based on measurements and similar projects.

- Capping grade is of 30 g/t Au on original assays.

Based on the Disclosure of NI43-101, Section 2.4

- The source is Komet’s NI43-101 that is effective January,7, 2019

- We consider the reliably and relevance to be reasonable

- The key assumptions are listed above (1-10) Above

- The categories are similar

- There are no recent estimates

1 Technical Report (NI43-101) dated March 5, 2019 (Effective Date: January 7, 2019) with Title Page, “Dabia Sud Property, Kabaya Resource, NI 43-101 Technical Report, Mali”, prepared by Yann Camus, P. Eng. And Didier Ouedraogo, P. Geo., SGS Geological Services, and filed on SEDAR on March 5, 2019.

Exciting results from hole DDDBS20-014, which intersected 1.93 gpt gold over 7m from 233.2m and ended in gold mineralization at 247.2m (Figure 2), has reinforced the need for even deeper drilling. The recent addition of our 6th rig, which has a maximum depth drilling capability of 1,400m, will greatly facilitate this deeper drilling (see news release 5th January 2021). The Kabaya deposit remains open at depth and along strike and has become another priority target for follow up drilling in 2021.

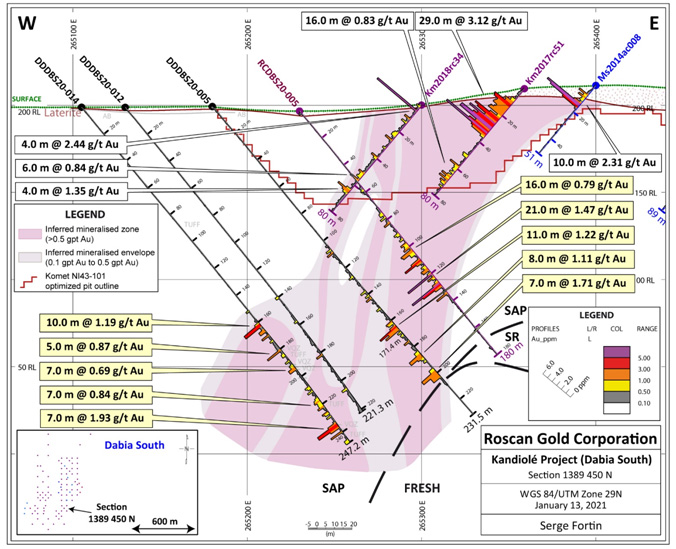

Roscan believes that the Kabaya deposit is part of a significant structural corridor which spans from Oklo Resources discoveries of Seko and Disse, to the North East of our land package and then extends for 22km on our property, from Kabaya to our recent Kandiole North Discovery (KN2) and onto our recently acquired Mankouke West Land Package, which shows a strong magnetic signature similar to the other discoveries on this corridor. (Figure 3 and news release 11th January 2021). Much of this 22km corridor has yet to be tested and thus, Roscan feels that the potential for new discoveries in this corridor is excellent and connecting these multiple targets via step out drilling will be a key priority in 2021.

Nana Sangmuah, President and CEO, stated, “These are very exciting times for the Company as we continue our success rate with additional positive results at Kabaya. These results demonstrate the potential of the magnetic structure in the corridor that extends for 22km from Kabaya to our newly acquired Mankouke West Target. This is one of five major trends of gold mineralization on our property and we will continue to aggressively drill to build ounces on these targets in 2021.

Since acquiring Kabaya in 2020, we have extended the average depth of mineralization from 58m to a vertical depth of 196 meters. Importantly, hole DDDBS20-014 our deepest intercept to date, ended in gold mineralization and remains open. This projected depth potential in gold mineralization and fresh rock will be another high priority for the Company. The drilling results, to date, have shown the potential to significantly increase the size of the gold occurrence at Kabaya.”

Figure 1: Plan View delineating the new holes drilled at Kabaya Deposit

Figure 2: Cross Section depicting Depth and High-Grade Continuity – DDDBS20-014

Figure 3: Plan View of Kabaya Deposit with Magnetic Signature on the entire Property

The gold mineralization at Kabaya (Figure 4) is associated with albite-dolomite-pyrite alteration in greywackes and diamictites of the Kofi Formation. The alteration observed in the core indicates a strong hydrothermal system commonly associated with gold deposits in this area.

Figure 4: DDDBS20-08 Kabaya: 2.96 gpt Au/30m from surface including 11.7 gpt Au/2m from 26m

Drilling Contract and Analytical Protocol

The drilling was performed by Geodrill who employs multi-purpose (AC/RC/DD) rigs and AC rigs at the Kandiole Project. The AC drilling is mainly focused on drilling exploration targets.

The Diamond Core and RC samples are sent for preparation to Bureau Veritas Mineral Laboratories in Bamako, Mali and assayed at their analytical facilities in Bamako and in Abidjan, Ivory Coast with fire assay with atomic absorption finish and by gravimetric finish for grades above 10gpt Au.

Roscan applied industry-standard QA/QC procedures to the program. Certified reference materials, blanks and field duplicates are inserted at appropriate intervals.

Figure 5: Kabaya Small-Scale Operation depicting the significant potential

Table 1: Drillhole Highlights at Kabaya Deposit (January 18th, 2021)

| Hole ID | From (m) | To (m) | Interval (m) | gpt Au | Comment |

|---|---|---|---|---|---|

| Oxides unless otherwise noted | |||||

| DDDBS20-001 | 5 | 8 | 3 | 0.84 | |

| 88 | 89 | 1 | 0.75 | ||

| 193 | 194 | 1 | 1.97 | FRESH | |

| DDDBS20-002 | 40 | 43 | 3 | 3.95 | |

| 47 | 50 | 3 | 1.02 | ||

| 58 | 59 | 1 | 0.51 | ||

| 66 | 69 | 3 | 1.36 | ||

| 72 | 76 | 4 | 0.73 | ||

| 79 | 81 | 2 | 1.00 | ||

| 92 | 94 | 2 | 1.58 | FRESH | |

| 121 | 122 | 1 | 6.02 | FRESH | |

| 133 | 135 | 2 | 2.71 | FRESH | |

| 154 | 169 | 15 | 0.79 | FRESH | |

| DDDBS20-003 | 0 | 0.8 | 0.8 | 1.25 | LAT |

| 57.8 | 66.8 | 9 | 1.64 | SR | |

| 70.8 | 72.8 | 2 | 0.90 | FRESH | |

| 76.6 | 78.6 | 2 | 0.78 | FRESH | |

| 84.6 | 87.6 | 3 | 10.6 | FRESH | |

| including | 84.6 | 85.6 | 1 | 24.6 | FRESH |

| 91.6 | 92.6 | 1 | 0.53 | FRESH | |

| 96.6 | 98.6 | 2 | 1.96 | FRESH | |

| 104.6 | 108.6 | 4 | 0.78 | FRESH | |

| 123.6 | 124.6 | 1 | 0.59 | FRESH | |

| RCDBS20-001 | 0 | 6 | 6 | 0.57 | LAT |

| 64 | 78 | 14 | 0.99 | SAP+SR | |

| RCDBS20-002 | 127 | 129 | 2 | 3.20 | SR |

| 133 | 138 | 5 | 1.57 | SR+FRESH | |

| 141 | 159 | 18 | 1.28 | FRESH | |

| RCDBS20-003 | 66 | 69 | 3 | 0.65 | |

| 125 | 126 | 1 | 0.58 | ||

| 128 | 132 | 4 | 0.56 | ||

| DDDBS20-004 | 118.3 | 119.3 | 1 | 0.55 | |

| 141.3 | 142.3 | 1 | 0.62 | ||

| 146.3 | 147.3 | 1 | 0.57 | ||

| DDDBS20-005 | 106.3 | 109.3 | 3 | 0.79 | |

| 126.3 | 127.3 | 1 | 0.81 | ||

| 137.3 | 143.3 | 6 | 0.57 | ||

| 150.3 | 151.3 | 1 | 0.74 | ||

| 160.3 | 171.3 | 11 | 1.22 | ||

| 175.3 | 176.3 | 1 | 1.01 | ||

| 183.3 | 191.3 | 8 | 1.11 | ||

| 196.3 | 203.3 | 7 | 1.71 | ||

| DDDBS20-006 | 53.2 | 56.2 | 3 | 1.02 | |

| 59.2 | 60.2 | 1 | 0.67 | ||

| 116.2 | 118.2 | 2 | 1.22 | ||

| 122.2 | 124.2 | 2 | 0.80 | ||

| 143.2 | 158.2 | 15 | 1.07 | ||

| 162.2 | 163.2 | 1 | 2.28 | ||

| 166.2 | 183.2 | 17 | 2.66 | ||

| including | 171.2 | 173.2 | 2 | 7.45 | |

| 199.2 | 200.2 | 1 | 0.76 | FRESH | |

| DDDBS20-007 | 17 | 19 | 2 | 1.37 | |

| 29 | 32 | 3 | 0.65 | ||

| 40 | 41 | 1 | 0.89 | ||

| 51 | 52 | 1 | 0.50 | ||

| 55 | 61 | 6 | 1.03 | ||

| 66 | 70 | 4 | 1.14 | ||

| 75 | 78 | 3 | 0.65 | SR | |

| 84 | 86 | 2 | 8.26 | FRESH | |

| 89.8 | 96.8 | 7 | 0.77 | FRESH | |

| DDDBS20-008 | 0 | 30 | 30 | 2.96 | |

| including | 26 | 28 | 2 | 11.7 | |

| 34 | 49 | 15 | 1.54 | ||

| 58 | 62 | 4 | 0.72 | ||

| 66 | 67 | 1 | 1.26 | ||

| 93.8 | 95.8 | 2 | 2.20 | FRESH | |

| 118.8 | 119.8 | 1 | 0.74 | FRESH | |

| DDDBS20-009 | 0 | 4 | 4 | 0.68 | |

| 20 | 29 | 9 | 1.68 | ||

| 33 | 36 | 3 | 1.56 | ||

| 42 | 43 | 1 | 0.98 | ||

| 46 | 66 | 20 | 2.38 | SAP+SR | |

| including | 64 | 65 | 1 | 11.9 | SR |

| 69.5 | 70.5 | 1 | 0.59 | FRESH | |

| 74.5 | 79.5 | 5 | 0.78 | FRESH | |

| 106.5 | 107.5 | 1 | 1.03 | FRESH | |

| 110.5 | 112.5 | 2 | 1.67 | FRESH | |

| DDDBS20-010 | 0 | 13 | 13 | 1.71 | LAT+MZ |

| 18 | 21 | 3 | 2.16 | ||

| 24 | 25 | 1 | 0.90 | ||

| 38 | 39 | 1 | 0.64 | ||

| DDDBS20-011 | 0 | 1 | 1 | 1.14 | LAT |

| 48 | 50 | 2 | 1.03 | ||

| 53 | 54 | 1 | 0.94 | ||

| 86 | 87 | 1 | 0.95 | ||

| RCDBS20-004 | 41 | 42 | 1 | 3.83 | |

| 60 | 63 | 3 | 1.01 | ||

| 78 | 79 | 1 | 2.89 | ||

| RCDBS20-005 | 58 | 59 | 1 | 0.54 | |

| 75 | 79 | 4 | 0.63 | ||

| 82 | 83 | 1 | 1.12 | ||

| 90 | 106 | 16 | 0.79 | ||

| 109 | 130 | 21 | 1.47 | ||

| 134 | 135 | 1 | 2.14 | ||

| DDDBS20-012 | 139.4 | 140.9 | 1.5 | 0.52 | |

| 157.1 | 158.1 | 1 | 0.52 | ||

| 181.1 | 182.1 | 1 | 1.10 | ||

| 205.1 | 206.3 | 1.2 | 0.92 | ||

| DDDBS20-013 | 113.3 | 114.3 | 1 | 0.71 | |

| 127.3 | 128.3 | 1 | 2.83 | ||

| 139.3 | 145.3 | 6 | 0.77 | ||

| 148.3 | 151.3 | 3 | 0.83 | ||

| DDDBS20-014 | 151.2 | 152.2 | 1 | 0.51 | |

| 160.2 | 170.2 | 10 | 1.19 | ||

| 173.2 | 174.2 | 1 | 0.60 | ||

| 180.2 | 185.2 | 5 | 0.87 | ||

| 188.2 | 195.2 | 7 | 0.69 | ||

| 207.2 | 211.2 | 4 | 0.63 | ||

| 215.2 | 222.2 | 7 | 0.84 | ||

| 225.2 | 229.2 | 4 | 0.68 | ||

| 233.2 | 240.2 | 7 | 1.93 | ||

| 245.2 | 247.2 | 2 | 0.70 | End of the hole | |

| DDDBS20-015 | 0 | 9.3 | 9.3 | 3.09 | LAT+MZ |

| including | 4.3 | 6.3 | 2 | 8.73 | LAT |

| 38.3 | 44.3 | 6 | 0.80 | ||

| RCDBS20-06 | 38 | 39 | 1 | 0.63 | |

| 42 | 44 | 2 | 1.29 | ||

| 47 | 54 | 7 | 0.85 | ||

| 57 | 58 | 1 | 0.72 | ||

| 67 | 71 | 4 | 1.00 | ||

| 74 | 83 | 9 | 1.65 | ||

| RCDBS20-07 | 76 | 81 | 5 | 0.77 | |

| 84 | 92 | 8 | 0.87 | ||

| 103 | 104 | 1 | 1.52 | ||

| 107 | 111 | 4 | 0.99 | ||

| 115 | 120 | 5 | 0.94 | ||

| RCDBS20-08 | 100 | 101 | 1 | 1.72 |

Table 2: Drillhole ID Kabaya Deposit (January 18th, 2021)

| Hole ID | X Collar | Y Collar | Section | AZM | DIP |

|---|---|---|---|---|---|

| DDDBS20-001 | 265500 | 1389700 | 1389700 | 90 | -50 |

| DDDBS20-002 | 265520 | 1389650 | 1389650 | 90 | -50 |

| DDDBS20-003 | 265498 | 1389598 | 1389600 | 90 | -50 |

| RCDBS20-001 | 265692 | 1389685 | 1389700 | 270 | -50 |

| RCDBS20-002 | 265719 | 1389650 | 1389650 | 270 | -50 |

| RCDBS20-003 | 265701 | 1389600 | 1389600 | 270 | -50 |

| DDDBS20-004 | 265175 | 1389400 | 1389400 | 90 | -50 |

| DDDBS20-005 | 265180 | 1389450 | 1389450 | 90 | -50 |

| DDDBS20-006 | 265200 | 1389500 | 1389500 | 90 | -50 |

| DDDBS20-007 | 265575 | 1389526 | 1389525 | 270 | -50 |

| DDDBS20-008 | 265624 | 1389672 | 1389675 | 270 | -50 |

| DDDBS20-009 | 265604 | 1389602 | 1389600 | 270 | -50 |

| DDDBS20-010 | 265584 | 1389740 | 1389750 | 270 | -50 |

| DDDBS20-011 | 265555 | 1389850 | 1389850 | 270 | -50 |

| RCDBS20-004 | 265572 | 1389526 | 1389525 | 270 | -50 |

| RCDBS20-005 | 265230 | 1389450 | 1389450 | 90 | -50 |

| DDDBS20-012 | 265130 | 1389450 | 1389450 | 90 | -50 |

| DDDBS20-013 | 265182 | 1389550 | 1389550 | 90 | -50 |

| DDDBS20-014 | 265105 | 1389450 | 1389450 | 90 | -50 |

| DDDBS20-015 | 265520 | 1389740 | 1389750 | 90 | -50 |

| RCDBS20-06 | 265266 | 1389400 | 1389400 | 90 | -50 |

| RCDBS20-07 | 265220 | 1389400 | 1389400 | 90 | -50 |

| RCDBS20-08 | 265175 | 1389251 | 1389250 | 90 | -50 |

Qualified Person (QP) and NI43-101 Disclosure

Greg Isenor, P. Geo., Executive Vice-Chairman for the Company, is the designated Qualified Person for this news release within the meaning of National Instrument 43-101 (“NI 43-101”) and has reviewed and verified that the technical information contained herein is accurate and approves of the written disclosure of same.

About Roscan

Roscan Gold Corporation is a Canadian gold exploration company focused on the exploration and acquisition of gold properties in West Africa. The Company has assembled a significant land position of 100%-owned permits in an area of producing gold mines (including B2 Gold’s Fekola Mine which lies in a contiguous property to the west of Kandiole), and major gold deposits, located both north and south of its Kandiole Project in West Mali.

For further information, please contact:

Dr. Andrew J. Ramcharan, P.Eng

Executive Vice President – Corporate Development

Tel: (416) 572-2295

Email: aramcharan@Roscan.ca

Greg Isenor, P.Geo

Executive Vice-Chairman

Tel: (902) 902-221-2329

Email: gpisenor@Roscan.ca

Forward Looking Statements

This news release contains forward-looking information which is not comprised of historical facts. Forward-looking information is characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words, or statements that certain events or conditions “may” or “will” occur. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, and opportunities to differ materially from those expressed or implied by such forward-looking information. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, changes in the state of equity and debt markets, fluctuations in commodity prices, delays in obtaining required regulatory or governmental approvals, and other risks involved in the mineral exploration and development industry, including those risks set out in the Company’s management’s discussion and analysis as filed under the Company’s profile at www.sedar.com. Forward-looking information in this news release is based on the opinions and assumptions of management considered reasonable as of the date hereof, including that all necessary governmental and regulatory approvals will be received as and when expected. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information. The Company disclaims any intention or obligation to update or revise any forward-looking information, other than as required by applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.