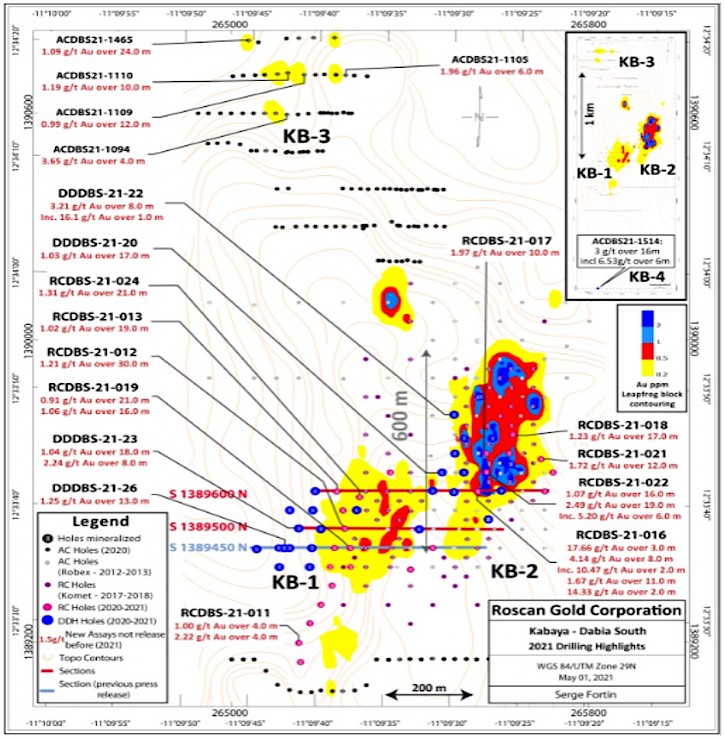

Significant Potential for Resources Growth

Remains Open at Depth and Along Strike

Kabaya Deposit – Acquired in July 2020

- Grade continuity and mineralization consistency reinforces our expectation for a robust new resource estimate at Kabaya by year end

- All intersected mineralization (January and May 2021)

- Kabaya Target depicts the magnetic structure extension of 15km into our recently acquired land package Mankouke West Land Package

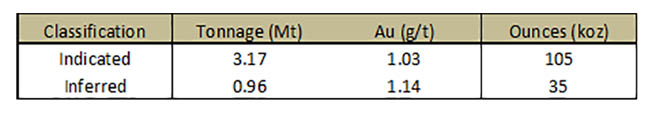

- Mineral Resource1 of 105Koz Indicated and 35Koz Inferred was pit-constrained to a depth of 58m

1 Technical Report (NI 43-101) dated March 5, 2019 (Effective Date: January 7, 2019) with Title Page, “Dabia Sud Property, Kabaya Resource, NI 43-101 Technical Report, Mali”, prepared by Yann Camus, P. Eng. And Didier Ouedraogo, P. Geo., SGS Geological Services, and filed on SEDAR on March 5, 2019.

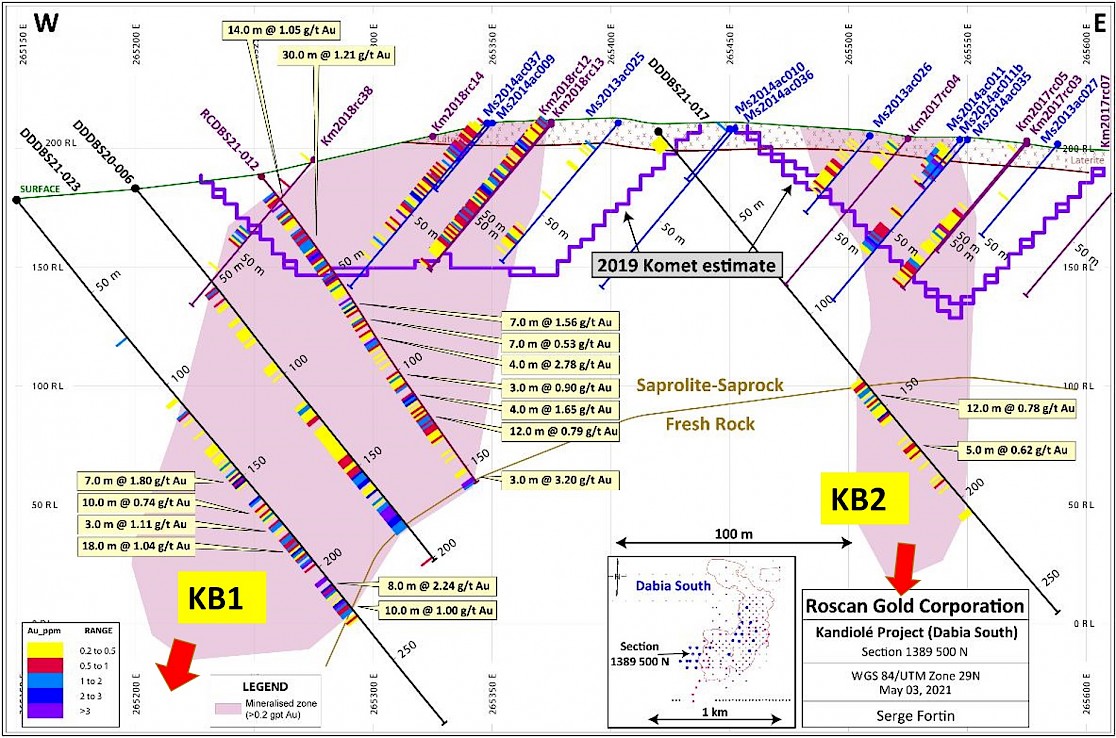

Shows Depth Potential and Higher Grades

Cross Section Depicting Depth and Grade Continuity

- Open at Depth and along Strike

- Drilling Highlights

♦ Vertical depth Extension at KB1 and KB2

♦ Remain Open at Depth

♦ KB2 in Fresh Rock

10.6 g/t Au over 3.0m - DDDBS20-003 from 84.6m

3.09 g/t Au over 9.3m - DDDBS20-015 from 0m

2.96 g/t Au over 30.0m - DDDBS20-008 from 0m

2.66 g/t Au over 17.0m - DDDBS20-006 from 166.2m

2.38 g/t Au over 20.0m - DDDBS20-009 from 46m

17.66 gpt Au over 3.0m - RCDBS21-016 from 16.0m

• Including 26.00 gpt Au over 2.0m from 16.0m

o And 14.33 gpt Au over 2.0m - RCDBS21-016 from 74.0m

o And 2.29 gpt Au over 19.0m - RCDBS21-016 from 23.0m

• Including 10.47 gpt Au over 2.0m from 39.0m

3.06 gpt Au over 16.0m - ACDBS21-1514 from 30m

• Including 6.53 gpt gold over 6m from 34m

1.38 gpt Au over 12.0m - ACDBS21-1515 from Surface

• Including 3.25 gpt gold over 4m from 8m

1. Kabaya Project

The Kabaya deposit has an “historical estimate” (see Press Releases dated May 11 and June 17, 2020) that is pit-constrained with 105,000 ounces of Indicated Resource and 35,000 ounces of Inferred Resource which has been drilled to an average depth of 80m, and the deposit remains open at depth.

Location Map of Dabia Sud Property with Roscan and Oklo Resources

The Kabaya historical estimate is based on optimized pit shells using a gold price of US$1,350 and a presumed heap leach gold recovery of saprolite material.

The Kabaya historical estimate is based on optimized pit shells using a gold price of US$1,350 and a presumed heap leach gold recovery of saprolite material.

Pit Constraint Historical Estimate (Source Komet’s NI43-101)

1. Effective date for resources is January 7, 2019. (Source Komet’s NI 43-101)

2. The independent QP for this resource estimate is Yann Camus, Eng., SGS Canada Inc.

3. The mineral Resources are presented at a 0.4 g/t Au cut-off grade in pits.

4. The resources are presented without dilution.

5. Whittle pits have been utilized based on a gold value of US$1,350/oz.

6. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

7. No economic evaluation of the resources has been produced.

8. This Resource Estimate has been prepared in accorance with CIM definitiion (2014).

9. Density used is of 1.7 based on measurements and similiar projects.

10. Capping grade is of 30 g/t Au on original assays.

Based on the Disclosure of Historical Estimate of NI 43-101, Section 2.4

a) The source is Komet’s NI 43-101 that is effective January 7, 2019;

b) We consider the reliability and relevance to be reasonable;

c) The key assumptions are listed above (1-10);

d) The categories are similar (the historical estimate was prepared using CIM definitions);

e) There are no recent estimates;

f) The QP needs to complete due diligence to verify the historical estimate;

g) The qualified person has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserves; and

h) The issuer is not treating the historical estimate as current mineral resources or mineral reserves.